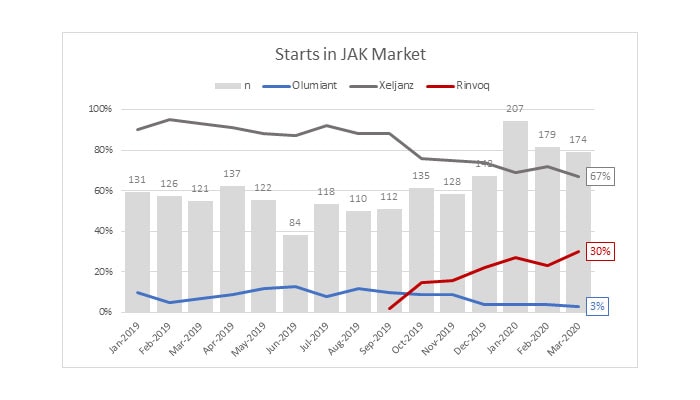

Analysis of the American Rheumatology Network-Trio Health (ARN-Trio) registry finds that AbbVie’s Rinvoq use is increasing rapidly as a proportion of JAK inhibitor use.

Rheumatologists are asking, why is use of AbbVie’s Rinvoq increasing so rapidly? Given the higher cost of Rinvoq (annual net price $44,035) and similar safety and efficacy across the JAK inhibitor class, the evidence suggests that Rinvoq adoption is driven by formulary exclusions.[i]

Formulary exclusions are powerful tools used by pharmacy benefit managers (PBMs) to negotiate deeper rebates from manufacturers. Manufacturers who do not offer satisfactory rebates face exclusion from the PBM’s national formulary. Unfortunately for patients and plans, drug cost is not as important to a PBM as is the amount of the rebate. Paradoxically, these rebates have led to increasing drug prices with manufacturers increasing drug prices to mitigate lost revenue from rebates.

Rebates and formulary restrictions prevent patients from accessing effective treatment.

In rheumatoid arthritis, one form of formulary restriction, step therapy, is associated with a 19% lower odds of treatment effectiveness, increased utilization of glucocorticoids and nonsteroidal anti-inflammatory drugs, and risk of serious infection.[ii]

Finally, rebates are not transparent to plans or patients. Concern exists that PBM profits are related to choosing medications with high list prices and high rebates. These practices increase patient cost sharing (paid in proportion to the list price of the medication), and these high costs interrupt biologic DMARD therapy.[iii]

These perverse incentives create a dysfunctional marketplace, where lower cost agents such as Olumiant are excluded by plans, favoring increased use of the more expensive medications such as AbbVie’s Rinvoq. AbbVie’s revenues from the blockbuster Humira comfortably subsidize the rebates offered on Rinvoq, creating a “winner takes all” environment, effectively insulating the market from competing (and lower cost) brands.

ARN and Trio Health will continue to monitor these patterns to inform colleagues and patients about how formulary restrictions, and the underlying rebates to PBMs, prompt manufacturers to raise their already too-high list prices and impose higher patient cost sharing (either directly, or through increased plan premiums.)

[i] RA Update: Final Evidence Report and Meeting Summary [Internet]. 2020 [cited 2020 May 14]; Available from: https://icer-review.org/wp-content/uploads/2019/03/ICER_RA_Final_Evidence_Report_and_Meeting_Summary_010820.pdf

[ii] Pharmacoecon Open. 2020 Mar;4(1):105-117.

[iii] Arthritis Care Res (Hoboken) 2016;68:1624–30.